Most purchase agreements involving the sale of a business have provisions protecting both the buyer and seller to ensure the business continues to operate in the normal course throughout the negotiation period and up until the keys are handed over to the buyer.

One of the most common means of protecting the interests of both parties is through the use of a net working capital mechanism.

What is net working capital?

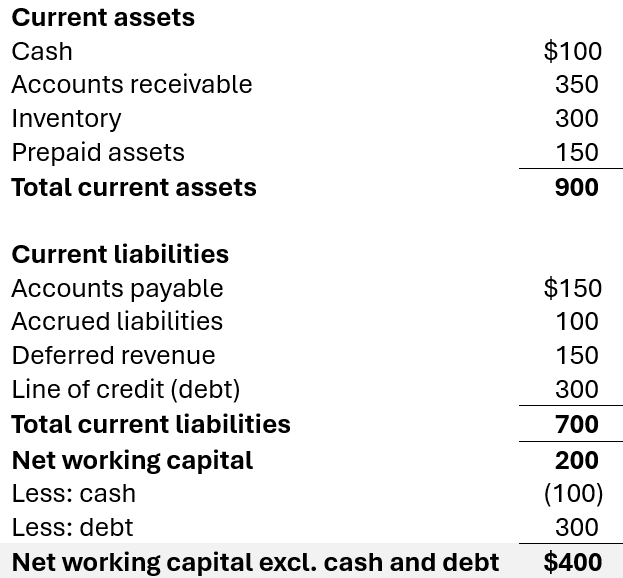

Working capital accounts include (i) current assets – all the resources readily available to the company to operate (cash in the bank, accounts receivable, inventory, prepaid assets, etc.) and (ii) current liabilities – all the short-term payables/obligations the company owes in the coming year (accounts payable, accrued liabilities, short-term loans, etc.).

Net working capital is the difference between the current assets and current liabilities, i.e., the difference between what the company has readily available and what it owes in the near term.

In the context of a cash-free, debt-free transaction, net working capital typically excludes cash and short-term debt (in a typical transaction, all cash on hand is swept by the buyer and all debt is paid off prior to or at transaction close).

Refer to the example calculation of net working capital below:

Why should I care about working capital?

The goal of a working capital mechanism in a purchase agreement is to make sure the business has a normal/sufficient level of working capital at transaction close so it may operate normally when the buyer takes the keys. A buyer doesn’t want to have to inject cash into the business on day one because the seller neglected to pay its bills in the lead-up to close. Conversely, a seller should be incentivized to run the business in the normal course, continue to chase new deals, and pay its bills through transaction close.

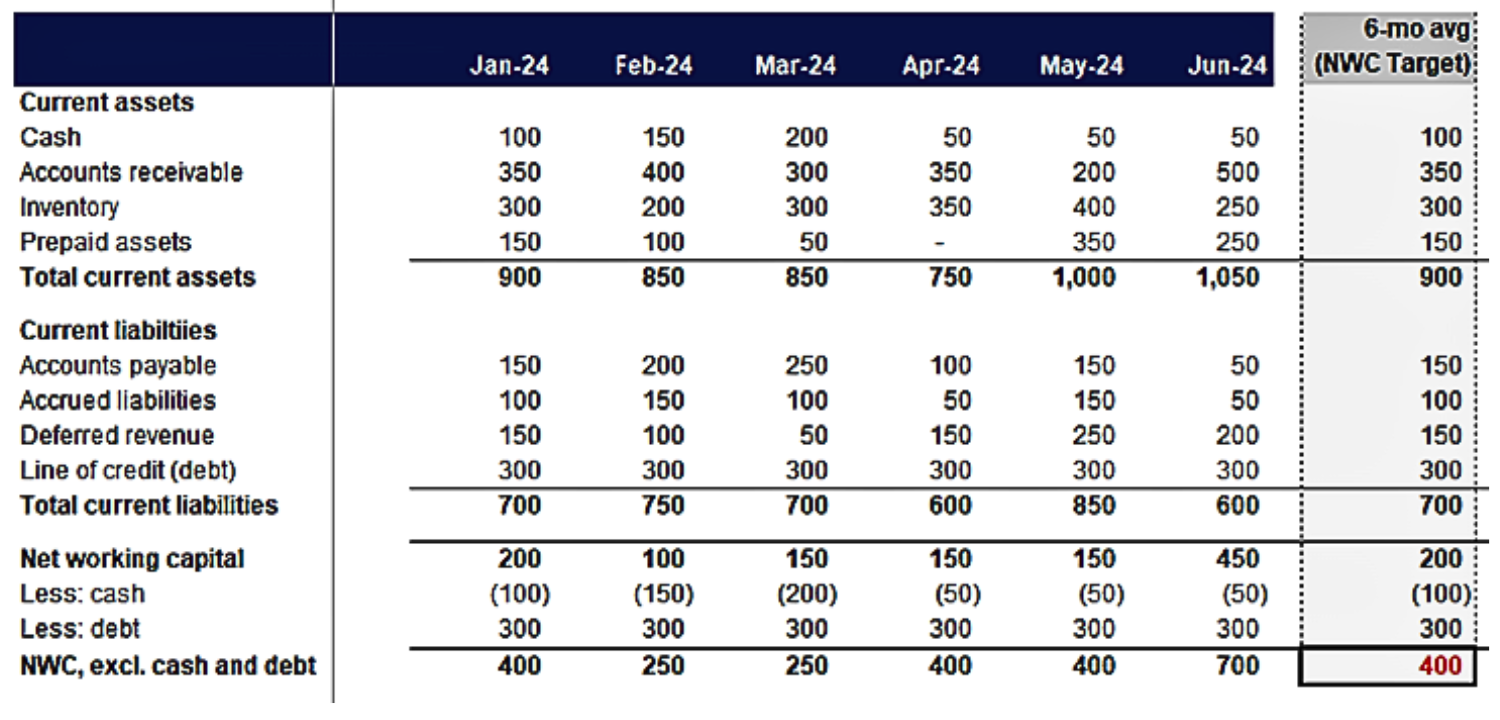

In a typical net working capital mechanism, a net working target is negotiated between the parties, generally calculated by analyzing normal month-end working capital levels over a preceding time period (e.g., trailing three, six or twelve months). That target is then measured against net working capital levels at transaction close and the difference is treated as a purchase price adjustment (more details below).

How it works

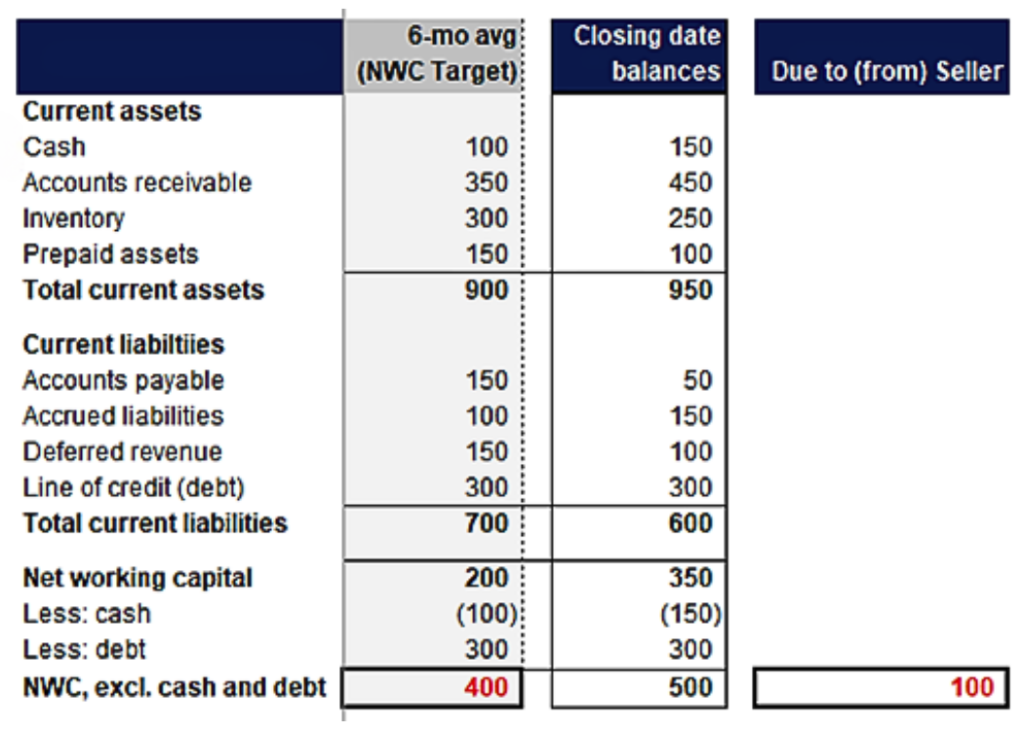

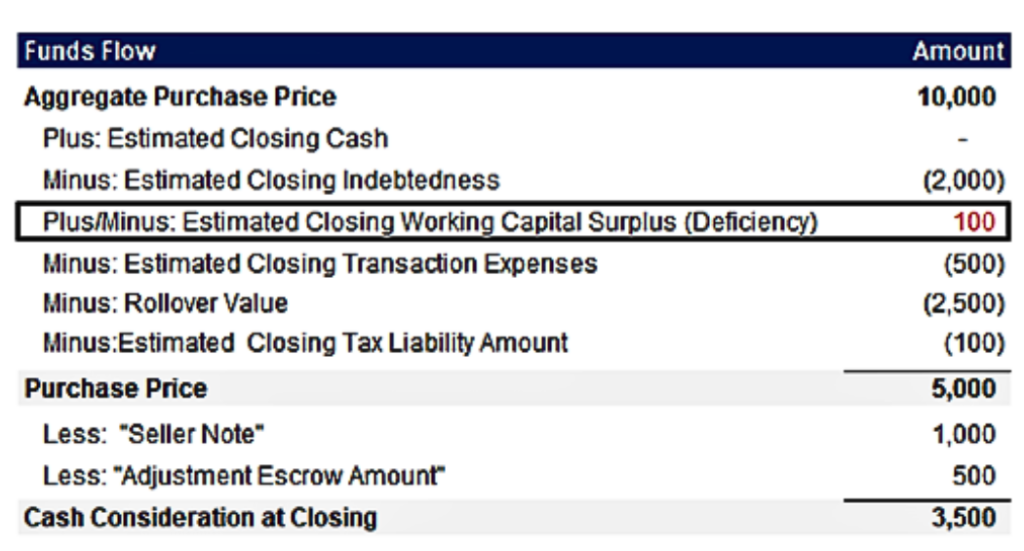

Let’s assume the negotiated net working capital target[1] is $400 as presented in the schedule above. If the sellers deliver excess net working capital at close (e.g., $500), they are compensated for that excess amount ($100).[2] For example, if the sellers had a great sales month in the lead-up to close and accounts receivable increased, they would be rewarded for the resulting increase in closing net working capital. Otherwise, the sellers would not be incentivized to operate in the normal course and pursue new business prior to transaction close.

Conversely, if the sellers delivered less net working capital at close (e.g., <$350), they should pay to make up the difference ($50). For example, if after signing an LOI the seller accelerated collections on accounts receivable and stopped paying the company’s bills, net working capital would decline at transaction close. As a result, the buyer would likely have to immediately inject cash into the business and pay past due bills on day one. In this case, the net working mechanism protects the buyers and compensates them for the lower net working capital delivered at close.

Fuel in the tank

We can use the analogy of fuel in the gas tank of a rental car to illustrate the purpose of a net working capital mechanism. Just as a buyer expects a normal level of working capital at transaction close, a person renting a car expects to receive the car with a reasonable level of fuel in the tank. The fuel is measured at the beginning of a rental agreement, and the renter is expected to bring back the car with the same level of fuel or be prepared to pay for the difference.

In this example, the fuel level measured at the beginning of a rental agreement is the net working capital target. The fuel level at the end of the rental agreement represents closing net working capital. If the car originally had a half tank of gas and the renter brought the car back with a half tank of gas, they call it even and there is no incremental fuel charge.

If the car is brought back on a tow truck because the renter ran out of gas, the renter will have to reimburse the rental car company for the original half tank. If life were fair, and the renter brought back the car with a full tank of premium unleaded, the rental car company would have to reimburse the renter for the incremental fuel.

Conclusion

No one wants to be shortchanged on the level of fuel in the tank when they buy or sell a business. The net working capital mechanism in an acquisition is like a “fuel gauge” that ensures both the buyer and seller are on the same page regarding the company’s operating resources at the time of the deal. In summary, the use of a net working capital mechanism in a purchase agreement helps ensure:

- Fair Value: Ensures the buyer is paying a fair price for the company’s actual operating resources (“fuel”) at the time of the acquisition. Conversely, helps ensure the sellers are compensated for excess “fuel” delivered at close.

- Smooth Transition: Helps the buyer avoid immediate cash shortages after the acquisition by ensuring the company has enough “fuel” to operate efficiently.

- Reduces Disputes: Clearly defines how to handle potential discrepancies in the company’s resources at the time of the deal, minimizing post-acquisition disagreements.

EXHIBIT I

Net Working Capital Target Calculation

EXHIBIT II

Calculation of Closing Net Working Capital Surplus (Deficiency) at Transaction Close

EXHIBIT III

Incorporation of Net Working Capital Surplus (Deficiency) in Transaction Funds Flow

______

[1] Refer to Exhibit I – Net Working Capital Target Calculation

[2] Refer to Exhibit II – Calculation of Closing Net Working Capital Surplus (Deficiency) at Transaction Close and Exhibit III – Incorporation of Net Working Capital Surplus (Deficiency) in Transaction Funds Flow