Most purchase agreements involving the sale of a business in the U.S. utilize a working capital mechanism to protect both the buyer and seller, helping ensure the business continues to operate in the normal course throughout the sale process.

However, in the ever-evolving M&A landscape, the European-style lockbox mechanism has emerged as an alternative strategy for buyers and sellers seeking a streamlined process and purchase price stability (i.e., no post-closing adjustments).

This article explores the lockbox mechanism, highlighting its benefits and contrasting it with a traditional working capital mechanism.

What is a lockbox mechanism?

The lockbox mechanism simplifies M&A transactions by setting a fixed purchase price based on the seller’s financial position at a predetermined date, a.k.a. the “lockbox date.” This approach eliminates the need for negotiating and setting a working capital peg and increasing or decreasing the purchase price based on working capital levels at transaction close. The result is that lockbox mechanisms provide buyers and sellers with better clarity and predictability of cash proceeds at close.

Key features

-

Lockbox Date – Typically aligned with the end of the last closed financial month or quarter, this date locks in key financial metrics, including net working capital.

-

Pre-Closing Financial Assessment – The purchase price is determined based on the seller’s financial position as of the lockbox date.

-

No Post-Closing Adjustments – The agreed-upon price remains unchanged after closing, regardless of subsequent financial fluctuations.

-

Economic Transfer – From the lockbox date onward, all profits and losses generated by the target company accrue to the buyer, who effectively assumes the economic risks and rewards of ownership.

In practice, prospective buyers evaluate the seller’s financial statements as of the lockbox date and submit bids based on the cash, debt and working capital at that time. A “leakage clause” in the purchase agreement ensures the sellers don’t make any unusual disbursements after the lockbox date (e.g., dividends, special bonuses, or abnormal payments). The purchase agreement also typically outlines “permitted leakage,” such as ordinary payroll and business expenses so the business can continue operating in the normal course. The sellers also warrant (or “rep to”) the accuracy of the financial statements, affirming the company’s true financial position as of the lockbox date.

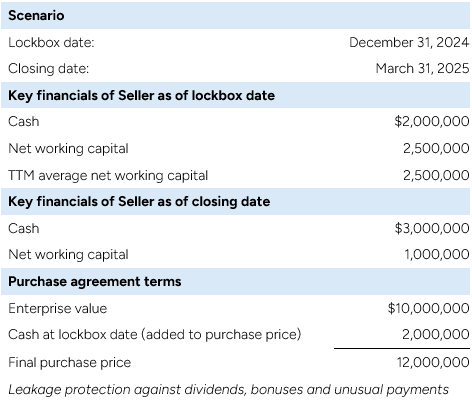

Example: Buyer acquiring Seller

Buyer’s perspective

Under a lockbox mechanism, in the above example the buyer pays $12 million for the business on March 31, 2025, confident that the financials as of December 31, 2024, were accurate and there was no leakage.

However, seasonal demands or an unforeseen downturn left the business with only $1,000,000 in net working capital at the closing date. Under a traditional net working capital mechanism methodology, the Buyers would be compensated for the lower working capital delivered at close via a purchase price reduction. Under a lockbox mechanism, there is no purchase price reduction at close to account for the lower working capital levels.

In addition, the economic benefits and risks from the lockbox date to closing accrue to the buyer; this means any profits or losses generated during this period go to the buyer regardless of outcome. This can be a somewhat risky proposition for buyers since they have no control over normal course business decisions made by the sellers until the transaction closes.

Seller’s perspective

Under a lockbox mechanism, the sellers are assured of receiving $12 million for the business regardless of what happens to net working capital after the lockbox date, so long as there is no unauthorized leakage. If unauthorized leakage is discovered (e.g., sellers pay $100,000 of special bonuses to certain personnel), the seller must reimburse the buyer for those amounts (typically stipulated in the purchase agreement indemnity clauses).

Key takeaways

- Simplicity and predictability – Lockbox mechanisms streamline the transaction by avoiding complex post-closing adjustments. In addition, they eliminate the risk of purchase price manipulation or “gaming the system” via buyer-friendly or seller-friendly net working capital provisions.

- Efficiency and collaboration – Lockbox mechanisms reduce time spent on potential disputes over net working capital adjustments. This is particularly important when the sellers roll over equity or remain on board post-transaction.

- Post-lockbox date earnings/losses – From the lockbox date onward, any profits or losses generated by the target accrue to the buyer. The buyer effectively assumes the economic risk and reward from the lockbox date to transaction close.

- Seller-favorable – Lockbox mechanisms are typically considered seller-friendly because they allow sellers to maintain control of pricing through closing. However, buyers can safeguard their interests via leakage provisions that clearly define permitted and unauthorized cash flows.

Conclusion

The lockbox mechanism offers a straightforward and predictable approach to M&A, ideal for transactions with stable targets and less complex terms. By incorporating robust protective measures in the sale and purchase agreement (i.e., leakage provisions), buyers can mitigate risks associated with locking in the purchase price months before transaction close.

While the lockbox mechanism provides simplicity and certainty, a traditional net working capital approach offers flexibility and reflects changes in value, albeit with more complexity. Selecting the appropriate mechanism depends on the transaction’s specific circumstances and objectives.

Please reach out to our transaction advisory team if you are considering whether to use a lockbox mechanism or a net working capital mechanism in your next transaction.